WCB insurance protects you and your employees in the event of a workplace injury or illness. Workers compensation insurance covers wages while your worker recovers, pays for extended healthcare benefits and protects you from lawsuits.

WCB premiums are based on a combination of the value of what is insured and the risk of incurring claims costs. We define risk as the potential cost of future workplace injuries (based on the costs of past claims) and determine value using the assessable payroll of your workforce.

Premiums and Risk

WCB premiums are based on risk, just like your home or vehicle insurance:

- If your workplace’s risk is higher than other employers, you will pay higher premiums.

- We assess your risk based on your past claims costs or experience with us. If you are a new customer, we assess your risk based on the past claims costs of other companies with similar business activities. We put your business in a group of similar businesses called an industry classification.

- Workers compensation premiums are a blend of collective and individual liability. This means your premium rate is based on a combination of the risk of potential injury costs at your workplace and the risk at workplaces with similar business activities.

- There are steps you can take to reduce your risk and potentially reduce your premium.

Premiums and Rates

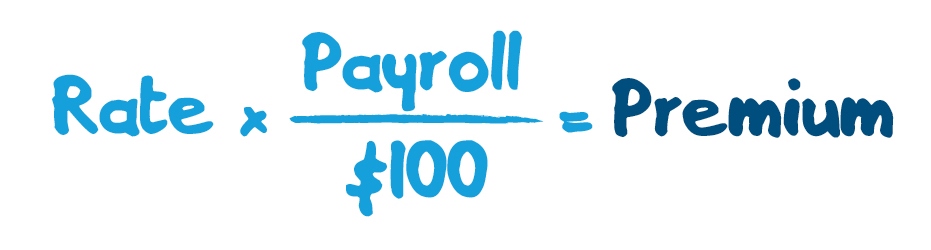

Your WCB rate is multiplied by every $100 of your payroll to determine your annual premium.

How Your WCB Rate and Premiums are Calculated

All employer’s WCB rates are set based on a mechanism we call a rate model. The rate model balances collective liability and individual liability in order to:

- Promote and enhance workplace safety and health;

- Promote effective workplace disability management programs;

- Allocate the costs of the compensation system among employers in a fair manner;

- Balance rate stability with rate responsiveness; and

- Maintain the financial integrity of the workers compensation system.

Learn more about the rate model and how rates are calculated

Rate Notifications

The rate notification is a customer-friendly, easy-to-understand tool designed to help you understand your rate, how you compare to other employers, and what you can do to improve your business performance and reduce your WCB costs.

Did Your Rate Change in 2025? This May Be Why

If your rate changed in 2025, there may be a number of reasons why. Changes to your industry classification's experience or your own claims experience can be factors in any rate change you experienced.

How You Can Reduce Your Premium

Your rate and your payroll are the factors used to determine your WCB premium. Unless your annual payroll changes significantly, the rate you pay is the factor you can influence to reduce your premium. Your rate will likely increase or decrease based on the cost and number of injuries at your business. You can manage your WCB rate and premium by:

- Putting in place a safety and health program to reduce injuries;

- Putting in place a return to work or disability management program to reduce the length of time employees are off work after an injury; and

- Engaging with an industry-based safety program to reduce injuries in your industry classification group.

These programs can have many other benefits for your business, such as increasing productivity, improving morale and retaining a skilled workforce. Learn more:

Industry-Based Safety Programs and How They Help Your Business

More Information about Rates and Premiums