Your rate is based on a number a factors that affect your business with the WCB. These factors include:

- industry classification

- claims costs/experience

- business size.

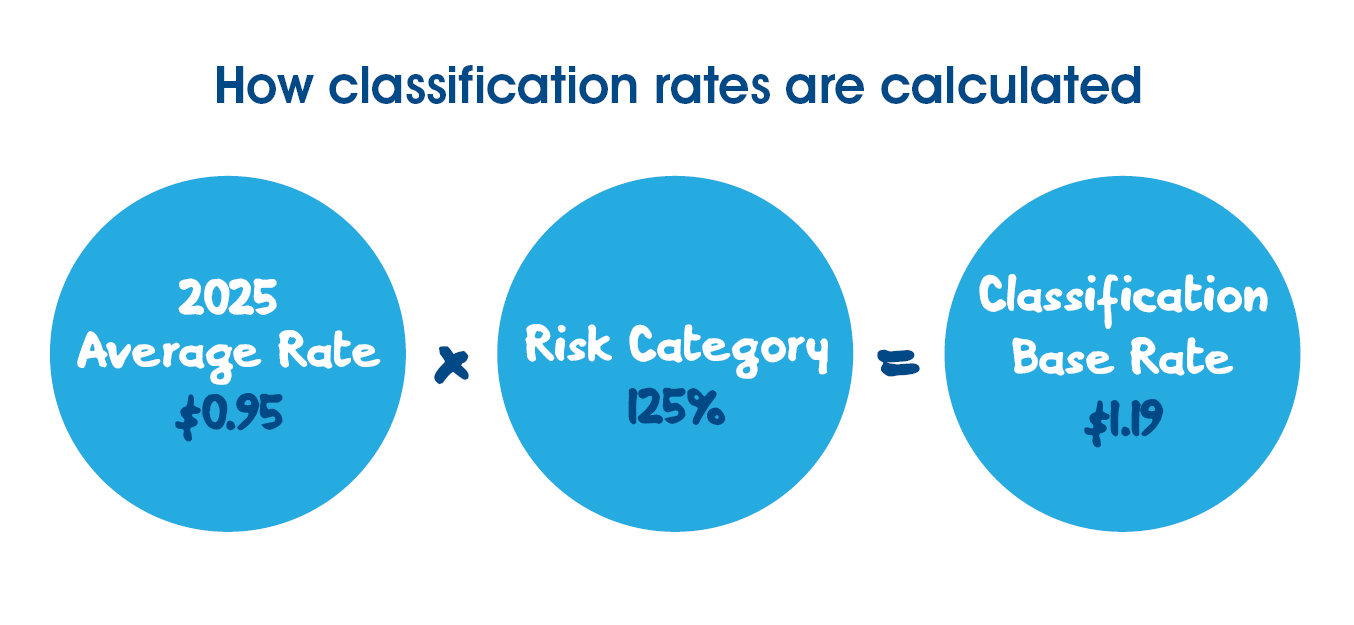

Workers compensation insurance premiums are based on a blend of collective and individual liability. This means your premium is based on a combination of the risk of potential injury costs at your workplace and the risk at workplaces with similar business activities. We group similar businesses together – this is your industry classification. There are approximately 175 industry classifications in Manitoba. When you register with the WCB, your business is assigned to an industry classification based on the kind of work you do. Each industry classification is assigned a risk category that describes their cost of injuries compared to the system average. The average rate is what you would pay if every employer paid the same WCB rate. The average rate is a baseline – we use it to set rates for each classification group. Find out more about your Industry Classification. When the total cost of injuries for all covered employers in Manitoba decreases, the average rate goes down and this decreases the baseline rate for all employers. If the average rate goes up, the baseline rate for all employers increases. Employers’ rates revolve around base rates. For new businesses, rates are fixed to the classification base rate for three calendar years. After three years, a new business’s rate will decrease or increase based on their claims cost experience. For 2025, the WCB will continue to maintain one of the lowest average rates in Canada at $0.95. Grouping similar employers together helps us promote and enhance workplace safety and health – everyone benefits when costs go down – while spreading out the costs of the workers compensation system among all businesses. View the Classification Base Rates for all Industry Classifications.How Does My Industry Classification Affect My Rate?

Your rate is set by measuring three full years of your costs from three full years of claims that you have filed with the WCB compared to the average. Generally, an employer who invests in safety and prevention and who makes every effort to return injured workers back to health and meaningful work will have lower claim costs and pay a lower rate. If you would like to know which claims costs will affect your rate, please refer to your Claim Transaction Statement. How do My Claims Costs Affect My Rate?

Employers are grouped according to their average payroll for rate setting. Your business size affects your rate in two ways: Rates for small and medium employers use a smaller rate range and greater percentage of the industry’s claim costs. This helps protect small and medium employers against volitile changes in their rate caused by sharp changes in their claims costs. An employer's claims cost experience carries different weight based on their size. A large employer's individual costs experience has a greater impact on the premiums they pay, but for smaller employers, the industry experience has a greater impact on what you pay. Small Employers Medium Employers Large EmployersHow Does My Business Size Affect My Rate?

The percentage of your individual experience used to calculate your rate

20%

30-40%

40-100%

The percentage of your classification's experience used to calculate your rate

80%

60-70%

0-60%

Your WCB rates are set based on a system we call the rate model. The rate model is how we make sure every employer pays their fair share of costs. Employers share the cost of the workers compensation system, while also paying higher or lower rates based on their own claims experience and the experience of the industry classification they share with other employers.What is a Rate Model?

WCB rates are generally set using an employer's previous years' claims experience. Because new employers don't have claims experience to factor into their rate, they receive the new employer rate identified for their industry classification. New employers will continue to receive the new employer rate each year until their own claims experience can be used to calculate their rate. An employer may receive the new employer rate for up to three years. The new employer rates are updated on our website each year. Once an employer has established two or more years of actual payroll information, they are assigned an employer size: small, medium or large, as well as a rate range that is associated with the size category. Learn more about Classification and Rate RangesRate Setting for New Employers

Workers compensation coverage is no-fault insurance – this means that workers are covered no matter how their work-related injury happens. If an injury does occur in the workplace, both you and your employees are protected. WCB coverage does this by: Download our Workers Compensation Coverage Overview FAQ for more information. If you are a business owner or are self-employed, Personal Coverage is available to give you workers compensation benefits if you are hurt at work. There are many benefits provided by Personal Coverage, including: Download the Personal Coverage for Business Owners Fact Sheet for more information. The WCB offers free one-day training workshops for employers on Return to Work Basics and WCB Basics. The workshops are designed for:What is the Value of the WCB?

Personal Coverage for Business Owners

Training