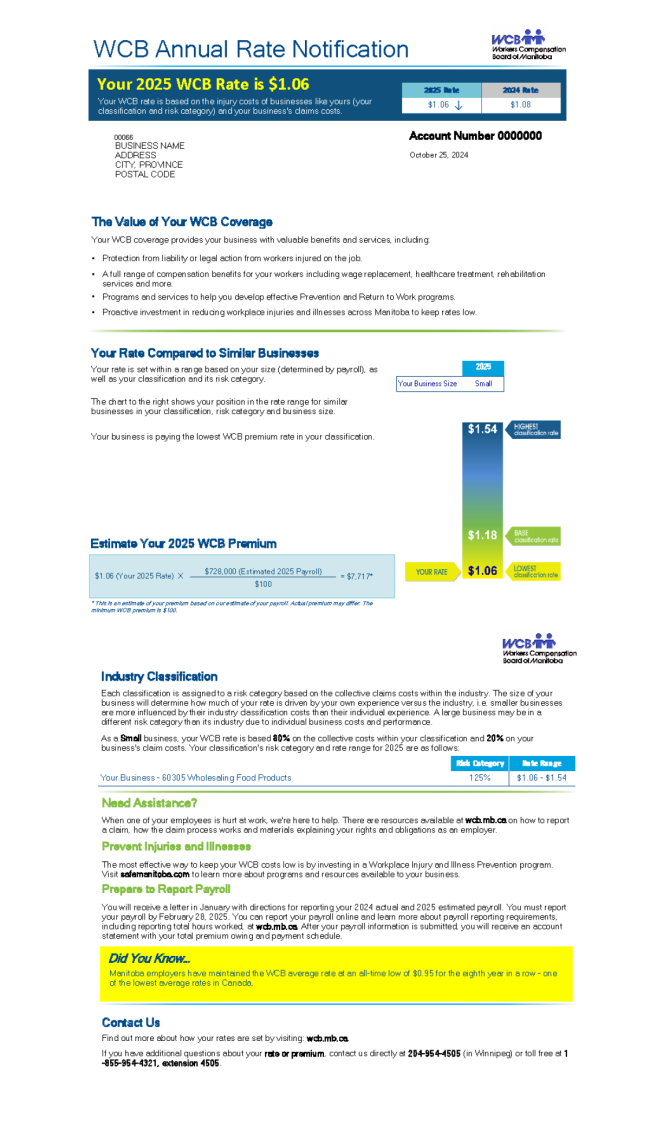

In the fall, the WCB provides you with an annual rate notification that explains your current rate and what your rate will be in the upcoming year. Your annual rate notification has information about your industry classification: whether your industry is trending towards a different risk category, the rate range for your business size, how you compare to other employers, and what you can do to improve your business performance and reduce your WCB costs.

Employers receive real value for their WCB coverage and the rate notification is a tool to illustrate that. We're evolving from our rate model to a broader rate system that includes not only rate-setting information but also prevention and Return to Work.

Do I Need to Do Anything With the Information in My Rate Notification?

The rate notification is for information only and is not an invoice – you aren’t required to do anything or send us any payment.

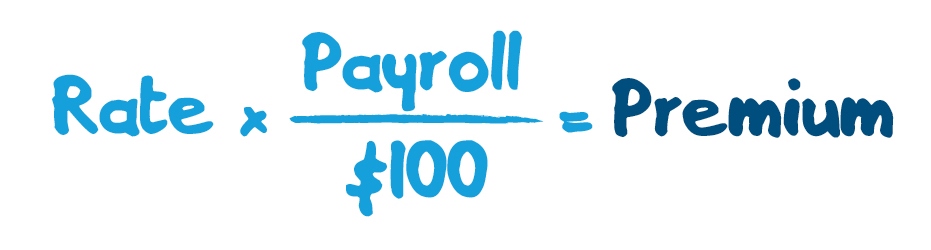

Many employers use their rate notification to estimate their WCB costs for the upcoming year's budget. It's a simple calculation to determine your approximate WCB premium based on your rate and estimated payroll for the year.

Your annual rate notification will also have information about your industry classification and the rate range for your business size.

In early January, you'll receive a request for Annual Payroll Information. This information is required by the last calendar day of February. We'll calculate your premium based on your rate and the payroll information you provide and send you an account statement based on your preferred payment schedule.

Sample Rate Notification

Click on the numbered areas in the sample Annual Rate Notification below to learn more.