If you own a business or are self-employed, you are not required to purchase workers compensation coverage for yourself. However, Personal Coverage is available to you to provide workers compensation benefits if you are injured at work.

Personal coverage is available to self-employed people and business owners including sole proprietors, business partners and directors of corporations.

WCB coverage for self-employed people and business owners provides similar benefits and services as those provided to workers in the event of a work-related injury. These include:

- income replacement benefits

- payment of allowable medical costs

- travel expenses if travel is required for medical treatment

- permanent impairment awards

- vocational rehabilitation

- benefits for dependents in the case of a fatality

To find out if you’re eligible for Personal Coverage, contact the Assessment Services Department at (204) 954-4505 or toll free at 1-855-954-4321.

For more information on Personal Coverage for business owners, see the frequently asked questions below.

How Much Does Personal Coverage Cost?

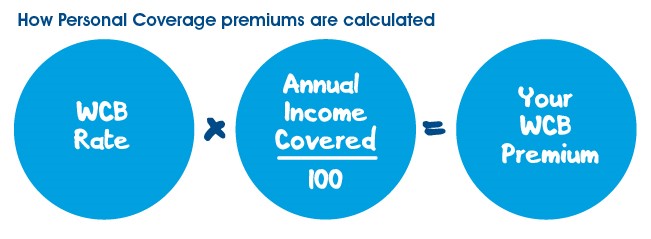

The WCB rate is the same for Personal Coverage as it is for workers in the same industry classification. Your WCB rate is based on your industry classification (a group of similar businesses) and your past claims costs (if any). Your premium is based on your WCB rate and how much of your income you want to insure.

For example, if your WCB rate is $1.25 and you want to cover $30,000 in annual income, your premium would be $375. We will tell you your WCB rate when you call to register.

How Much Personal Coverage Should I Buy?

You can purchase WCB coverage for any amount of annual income within the range set by the WCB. For 2025, the minimum is $30,140 and the maximum is $167,050.

When deciding how much coverage to purchase, you should consider your income level and your other sources of coverage. Buying too little coverage could mean your benefits will not be adequate, but buying more coverage than you need could mean you pay higher premiums than necessary. Before making your decision, you may want to consult with your financial advisor. See income replacement amounts for different levels of coverage.

If you decide to buy coverage for more than the minimum income level, you will need to provide proof of your earnings to receive income replacement benefits above the minimum. You can provide proof of your earnings when you purchase/renew your personal coverage or when you make a claim for income replacement benefits due to a work-related injury or illness. By providing proof of earnings when you purchase or renew your coverage, you will receive the full income replacement benefits you are entitled to more quickly, should you need to make a claim. If you decide to provide proof of your earnings when you purchase or renew your coverage, your verified earnings level will remain in effect for the current and next year.

If you choose not to provide proof of your earnings at the time of purchase/renewal, in the event of a work injury or illness, your income replacement benefits will be based on the minimum level of coverage at first. Your benefits will be retroactively adjusted once we have been able to verify a higher level of earnings.

Note: If you purchase more than the minimum, and your annual income falls between when you purchase coverage and when you make a claim for income replacement, you may ask us to refund the difference between the premium you paid and the premium you would have paid based on the verified lower earnings.

How Do I Provide Proof of My Earnings?

All you need to do to provide proof of your earnings is provide the WCB with permission to access your income tax returns from Canada Revenue Agency (CRA) or another independent source – we’ll do the rest.

How Does the WCB Verify My Earnings?

If an injury were to occur, and wage loss benefits are approved, we will review your income tax returns and supporting documents from the previous one to two years, and in some cased up to the previous five years. We may obtain this information from Canada Revenue Agency (CRA) or another independent source. On occasion, we may require additional documents such as your corporate income tax return and/or Statement of Business or Professional Activities to verify your earnings.

Directors With 50 Per Cent or More Ownership

To calculate earnings for Directors with 50 per cent or more ownership in a corporation, we add back the Director's shareholding percentage of net business income and depreciation/amortization to your reported T4 income.

Directors With Less Than 50 Per Cent Ownership

To calculate earnings for Directors with less than 50 per cent ownership in a corporation, we only consider reported T4 income.

Sole Proprietors and Partners

To calculate earnings for sole proprietors and partners, we add back the deductions taken for depreciation, amortization and business use of home expense to your reported net business income.

For example, if your income tax return recorded net business income of $20,000, an amortization deduction of $5,000 and a business use of home expense deduction of $2,000, your earnings would be calculates as $27,000 ($20,000 + $5,000 + $2,000).

Once we have calculated your earnings, income replacement benefits are based on the lesser of:

- the level of coverage you purchased

- the amount of earnings we can verify you earned in previous years.

When we approve the level of coverage requested based on the information provided, your coverage level will remain in effect for the current and next year. You may adjust and re-calculate your earnings at any time.

How Often Do I Need to Verify My Earnings Level?

Circumstances change. We recommend that you verify your earnings level once a year, before December 31. Your coverage will be automatically renewed every January 1; we will use any new information provided to us before December 31 to set your premium for the next year.

When is My Personal Coverage Activated?

Your coverage will come into effect once your application is accepted. Personal Coverage remains in effect until you cancel coverage or until we cancel your coverage because you did not fulfill our reporting and payment requirements.

How Do I Renew My WCB Coverage?

We will renew your Personal Coverage automatically on January 1 of each year at the same coverage level. If you purchased the minimum level of coverage, your coverage will be renewed at the new minimum level of coverage, which we recalculate annually.

For example, if you purchased the minimum level of coverage for 2024 ($28,960 when your coverage is renewed January 1, 2025, your coverage level is increased to the new 2025 minimum level of $30,140.

How Do I Change or Cancel My WCB Coverage?

To cancel your coverage or change the level of coverage you have, contact the Assessment Services Department. Be sure to let us know of any changes you need by December 31 of each year, especially if you are cancelling your coverage or want to reduce or increase your level of coverage. Otherwise your coverage will be automatically renewed on January 1 at the current level of coverage.

What Should I Do if I'm Hurt at Work?

Seek medical attention for your injury or illness. Be sure to tell your doctor your injury or illness is work-related. As soon as you can, report your injury to the WCB.

You may report the injury over the phone by calling the Claim Information Centre at (204) 954-4321 or toll free at 1-855-954-4321 from 8:00 a.m. to 7:00 p.m. Monday to Friday.

Learn More

Reporting Earnings and Paying Premiums for Personal Coverage

Income Replacement Benefits for Personal Coverage

Related Policies and Guidelines

Policy 35.10.120, Terms and Conditions of Optional and Personal Coverage